See what users say about GoSimpleTax

PRICING

All prices are inclusive of VAT. Which Member and Non-Member pricing highlighted below.

Special Offer – 25% off for non-members. For example, non-member was £59.99 now £44.99 (discount code will be sent via email when signed up).

⇤ Slide Left & Right ⇥

Which Member

£59.99 £19.99 /

TAX RETURN

Start Calculating

Key Features

-

Free Support

Email support Monday to Friday 9am – 5pm. (7 days per week in January).

-

Submit Directly to HMRC

Our software suggests tips to help you save on tax.

-

100+ Tax Saving Tips

Send your Self Assessment tax return directly to HMRC.

-

Self Employment (SA103)

Enter Sole Trade income and expenditure for each business you may have.

-

Property (SA105)

Enter property income and expenditure for the different rental types; Furnished holiday lettings, residential, commercial or rent-a-room.

-

Residency (SA109)

Notify HMRC of your residency/domicile, claim personal allowance or remittance basis, if relevant.

-

Basic Tax Return (SA100)

Complete your SA100 personal tax return and additional information pages.

-

Employment (SA102)

Enter P60, P45, P11D or other employment information (including expenses).

-

Ministers of Religion (SA102M)

Enter P60, P45 or other employment information, including expenses, as a Minister of religion.

-

Partnership (SA104)

Enter partnership profit/loss share (easily include entries from your partner statement).

-

Foreign (SA106)

Enter foreign income and gains [including foreign tax credit relief (FTCR)*] *manual calculation required.

-

Trusts (SA107)

Enter income received from a trust, settlement, or deceased person's estate (easily include entries from Form R185).

Please note: Only the individual’s income can be reported, form SA900 (used to file a full Trust and Estate Tax Return) is not supported. -

Capital Gains (SA108)

Include any gains or losses made (including any relevant relief claims).

-

Print Tax Calculation

You can print your tax calculation.

-

View Tax Calculation

View Tax Calculation

-

View Tax Owed

See how much tax you owe in real time.

-

Self Assessment Categorisation

All Self Assessment categorisations.

See More +

Start CalculatingNon-member Pricing

£59.99 £44.99 /

TAX YEAR

Start Calculating

Key Features

-

Free Support

Email support Monday to Friday 9am – 5pm. (7 days per week in January).

-

Submit Directly to HMRC

Send your Self Assessment tax return directly to HMRC.

-

100+ Tax Saving Tips

Our software suggests tips to help you save on tax.

-

Self Employment (SA103)

Enter Sole Trade income and expenditure for each business you may have.

-

Property (SA105)

Enter property income and expenditure for the different rental types; Furnished holiday lettings, residential, commercial or rent-a-room.

-

Residency (SA109)

Notify HMRC of your residency/domicile, claim personal allowance or remittance basis, if relevant.

-

Basic Tax Return (SA100)

Complete your SA100 personal tax return and additional information pages.

-

Employment (SA102)

Enter P60, P45, P11D or other employment information (including expenses).

-

Ministers of Religion (SA102M)

Enter P60, P45 or other employment information, including expenses, as a Minister of religion.

-

Partnership (SA104)

Enter partnership profit/loss share (easily include entries from your partner statement).

-

Foreign (SA106)

Enter foreign income and gains [including foreign tax credit relief (FTCR)*] *manual calculation required.

-

Trusts (SA107)

Enter income received from a trust, settlement, or deceased person's estate (easily include entries from Form R185).

Please note: Only the individual’s income can be reported, form SA900 (used to file a full Trust and Estate Tax Return) is not supported. -

Capital Gains (SA108)

Include any gains or losses made (including any relevant relief claims).

-

Print Tax Calculation

You can print your tax calculation.

-

View Tax Calculation

Your tax calculation broke down into section.

-

View Tax Owed

See how much tax you owe in real time.

-

Self Assessment Categorisation

All Self Assessment categorisations.

See More +

Start CalculatingHMRC - Officially recognised app that saves £££'s on accountant's fees

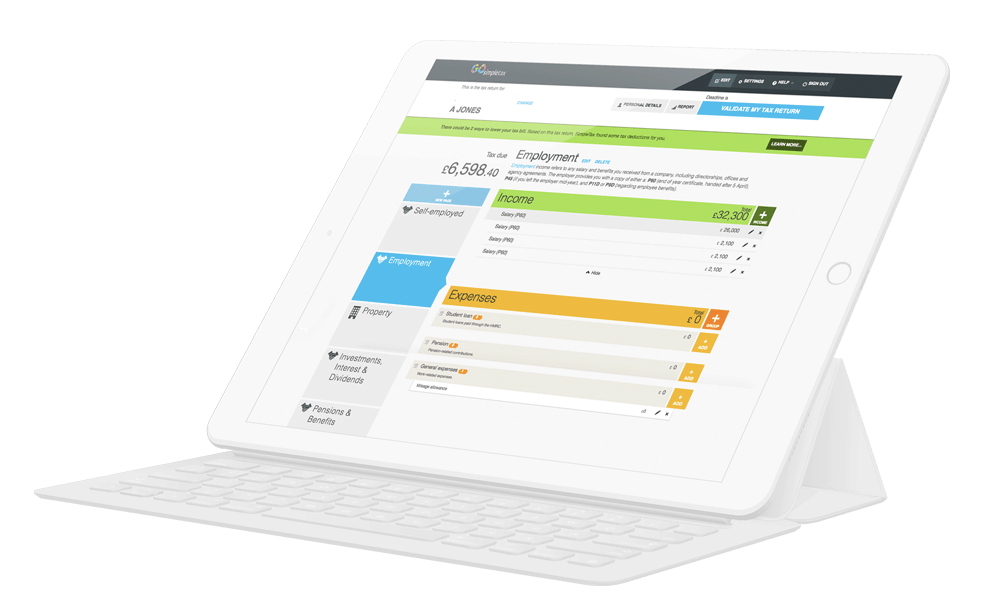

Self employed, employed, landlords, non-residents and even Ministers of Religion. There is no need to be a tax expert.

GoSimpleTax’s software is officially recognised by HMRC and ties in exactly with their requirements, so you don’t have to make any adjustments before you submit your tax returns.

We'll prompt you to claim all applicable allowances. We will accurately calculate your tax bill.

Your data is protected by the same 256-bit bank level security. Your data is backed up regularly. We're trusted by partners like Listetotaxman. We're officially recognised by HMRC.

Access GoSimpleTax via laptop, PC, tablet or mobile device. Our mobile app scans your receipts and invoices. Presented in jargon-free, intuitive design.

If it looks as though you’ve missed something, GoSimpleTax will let you know and give you the opportunity to rectify any accidental slip ups.

Disclaimer

Only your email address will be shared between Which? and GoSimpleTax in order to verify whether you are a Which? member. All information will be handled in accordance with parties respective privacy policies, for further information please see Which?’s privacy policy or visit GoSimpleTax’s website .